Business Valuation

How to evaluate a Business Value?

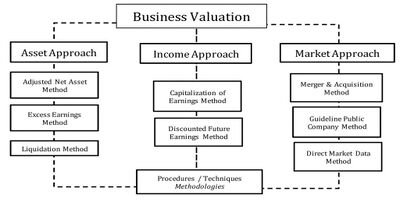

There are several ways to evaluate a business or brand to ascertain its near-to-accurate value.

We generally follow two methods and sometimes adopt more professional modes to get fair value.

First Method

- Value is dependent on the calculation or expectation of the parties involved

- Future cash flows of the Business

- Tangible capital asset available with Business

Second Method

Asset Method

- Book Value: Net Worth = Asset – Liabilities shown in Financial Statement

- Liquidation Value

Earnings & Cash Flow

- Future cash flows of Business

- Comparing current cash flows with future inflows to make projections

Documents Required

- Company Trade License

- Last 3 years VAT Returns / Balance Sheet

- Company Profile / Website Address

- Business Value Expectation

- Service Agreement for Consulting Permission & Fee Payment

Process Time

Any business Buy or Sell deal may take anywhere from 3 or 12 months depending on its size, nature and investments, factor.